Ask A Researcher

January 2018

WILLISTON BASIN 2016: EMPLOYMENT, POPULATION, AND HOUSING FORECASTS – An Overview

Deb Nelson and her staff at DLN Consulting, Inc. provide the administrative responsibilities for Vision West ND, a consortium of the energy producing counties in western North Dakota. Deb is the president of DLN Consulting, Inc. in Dickinson, North Dakota. Deb and her staff work primarily with nonprofit and government agencies and are always on the lookout for the latest information and data to help the agencies with their planning efforts. This article highlights a second study on housing, population, and workforce, which was commissioned by Vision West ND, for the 19 western North Dakota counties to provide planning information following the changes in population that was heavily influenced by the oil and gas industry.

.

North Dakota sits on top of the Williston Basin, a large North American geologic formation that is known for its rich deposits of oil and coal. The largest portion of the Williston Basin is located under North Dakota; however, the basin also spans into South Dakota, Montana, and Canada.

Evaluations of how development of shale oil might influence population in North Dakota began in 2010 (Ondracek et al. 2010) — a point in time when the industry began to substantially ramp up drilling activities to secure mineral leases in western North Dakota. As industry activity grew, so did the need to better understand the trajectory and magnitude of future population change. Economic expansion from 2010 through 2014 resulted in the doubling of some local populations where oil and gas development was most concentrated.

Although drilling activities have slowed in recent years, local governments in western North Dakota have continued to experience substantial changes in population. Therefore, Vision West ND contracted with Dr. Nancy Hodur, Center for Social Research, and Dean Bangsund, Department of Agribusiness and Applied Economics, from North Dakota State University to update a study they had completed in 2012 to provide planning data on future employment, population, and housing needs for western North Dakota counties and cities.

Estimating future population has been and continues to be a key issue for local governments in western North Dakota. For decades, a declining and aging population was the norm for most of the western counties, but the breakthrough in extraction of shale oil dramatically altered or reversed those long-term trends. It was hoped that specific population and housing forecasts could be related to potential levels of future employment.

The Study

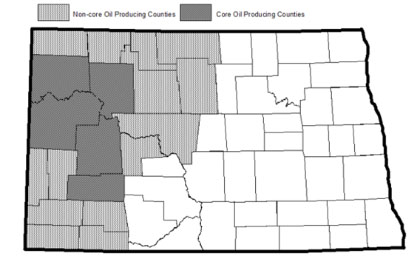

The purpose of the study was to provide the 19 oil, gas, and coal producing counties in North Dakota (Figure 1) with specific population and housing forecasts related to potential levels of future employment. The goal of the employment forecasts was to develop likely expectations for changes in the pace and size of shale oil development in North Dakota over the next 20 years, and for counties with low oil and gas impacts, develop projections that capture a reasonable range of future employment change given historical trends. The study offered three distinct scenarios based on different levels of oil prices for its projections – low price ($25-$60/barrel), moderate price ($60-$90/barrel), and high price (>$90/barrel). For the purposes of this article, we will concentrate on the projections at the low-price level.

Figure 1. The study’s oil and gas producing counties, North Dakota, 2016

Employment

The study forecasted anticipated changes in oil and gas employment, such as rig counts, oil field maintenance and transportation. It also forecasted changes in other industries, such as farming and ranching, and secondary employment industries that are required to be in place to support the population. The study forests that in the five core oil-producing counties (Dunn, McKenzie, Mountrail, Stark, and Williams), employment will continue to be dominated by the oil and gas industry. However, fewer rigs will need to be used because of advances in oil technology. Fewer rigs means fewer jobs will be required in the oil and gas industry directly.

In the low price scenario, employment from 2017 – 2040 will remain relatively unchanged (-0.5%). At the moderate price scenario, projections indicate a slight employment rate change (7%). Over the next 20 years, employment will be below that what it was at the 2014 peak, but it will be substantial enough to create some challenges for the western North Dakota region. Most of the infrastructure is in place for new well development, so it is unlikely that jobs will be required for building roads, developing well pads, or setting up offices for oil and gas industry.

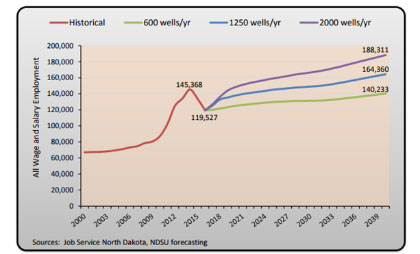

It is important to realize that not all employment growth will translate into permanent residents, as the workforce will not be limited to those residing in the immediate area. Similarly, employment in one location can affect the population and service employment needs in another location. The employment projections that most counties are looking for planning ate the 600 wells/year rate, which coincides with the low price scenario (Figure 2).

Figure 2. Employment (all wage and salary) trends and projections based on oil price scenarios, Williston Basin, North Dakota, 2000-2040

Note: Oil price scenarios are based on the number of oil wells per year. The low price scenario was estimated to range from 400 to 800 wells per year in North Dakota and is reflected as 600 wells per year in this figure. The moderate price scenario was estimated to range from 1,000 to 1,500 wells per year and is reflected as 1,250 wells per year. The high price scenario was estimated to produce 1,700 to 2,300 wells per year and is reflected as 2,000 wells per year in this figure.

Population

Population changes in the low-price scenario are likely to be around one percent per year. Most of the population growth will occur in the core oil producing counties, though we should see it occur in all counties, albeit at a very low rate. With the unlikelihood of rapid population growth, the counties should be able to stabilize from recent years. The study also identified that the population has become younger, which will require communities to make changes to meet the needs of this population.

Housing

Different age groups with a population require a variety of housing needs and the data suggests that there is some shifting from single-family housing to multi-family housing. It will be important to make sure the correct mix of housing is supplied, which will include provisions for affordability, renting versus buying, and permanent and temporary accommodations. In most locations the housing crisis has abated. Now that the housing crisis is more under control, it will be very important that planners, developers, and city management work to provide housing that meets new worker preferences.

What was learned from the study?

The findings do not suggest a return to the employment growth or a quick return to the peak employment experienced in the Williston Basin from 2010 through 2014. The projections do indicate that employment levels are likely to remain at or slightly above the current levels, even in the lowest price environments. However, if the price of oil reaches a moderate or high range, western North Dakota will see substantial population growth, followed by increased employment needs and housing requirements that fit the population expansion.

The study produced a number of materials for the stakeholders in western North Dakota. The report focuses on study assumptions and scenarios and covers an overview of the study results. County specific data files, a webinar, and a PowerPoint presentation were provided for each of the 19 counties.

The Williston Basin 2016: Employment, Population, and Housing Forecasts, July 2017 study and the all additional county materials are available at www.visionwestnd.com.