Ask A Researcher

May 2018

Is food access a concern in rural North Dakota?

BY: Lori Capouch, Rural Development Director N.D. Association of Rural Electric Cooperatives with input from Neil Doty, N.C. Doty & Associates.

Lori Capouch is a development professional who leads rural people through the grassroots development process, empowering them to create the businesses they desire in their communities. She is the rural development director for the North Dakota Association of Rural Electric Cooperatives (NDAREC) where she oversees the Rural Electric and Telecommunications (RE&T) Development Center located in Mandan, North Dakota.

To compliment her development work with NDAREC, Lori provides administrative services to the Rural Development Finance Corporation, the North Dakota Rural Rehabilitation Corporation and the State Board of Agricultural Research and Education. She serves as vice chair on the CooperationWorks board of directors and secretary/treasurer for Dakotas America, LLC's board. Lori holds a BS in business management from the University of Mary, Bismarck, North Dakota. She is a certified economic development finance professional by the National Development Council. Capouch is a 2018 Fellow for the Business Alliance for Local Living Economies or BALLE.

Neil Doty is the president of N.C. Doty & Associates, LLC. Doty is assisting the RE&T Development Center with its distribution feasibility work for rural grocery stores. For this article Doty provided the map and narrative regarding collaboration among grocery stores.

The distance map and primary wholesale supplier map have been created by the Upper Great Plains Transportation Institute (UGPTI). UGPTI is a research, education, and outreach center at North Dakota State University.

In rural areas (communities with a population of 2,100 or less) of North Dakota there are currently 123 operating grocery stores - 14 stores operate under some sort of nonprofit model, for example, community-owned, 501c3, or tribally-owned; 27 stores operate under multi-store ownership to purchase in larger volumes, gain operating efficiencies and increase net profit margins; and 14 stores have closed since 2015 (10%). A few years ago, I began receiving phone calls from rural grocery operators. They were searching for grant funds for a variety of things, such as cooler replacements and heating systems upgrades. Most alarmingly, several were searching for operating funds because they were no longer able to break-even. Our office received so many calls that we began to wonder whether there had been a shift in the industry causing the operators to feel the financial stress.

A little Internet research quickly revealed that North Dakota was not alone. Across the Heartland, rural grocery operators were struggling to keep their doors open. Why is this a concern? Because healthy food access is the heartbeat of our rural communities. According to the United States Department of Agriculture, a rural food desert is defined as an area where people need to drive ten miles or more to access a full-service grocery store. Within rural communities, our businesses depend on access to a local grocery store. Grocery stores are “economic anchors” that draw in foot traffic to support other businesses. They not only create local jobs, but also foster other commercial development and breathe new life into neighborhoods. Without local access to food, businesses will have difficulty recruiting new employees to come to work for them. One of the first things families look for when moving to an area is a grocery store. They want to know where they will be purchasing their food. School enrollment numbers will suffer when there isn't convenient access to healthy food. In fact, our health depends on it. According to the United States Department of Agriculture, people who live in food deserts have a higher incident of obesity and diabetes.

With the issue before us, we set out to collect data that defined the challenges our grocers face and to identify potential opportunities to enhance their sustainability. In 2014 we launched our first rural grocer survey. Our goal was to visit each store and hand-deliver the survey. With the help of NDSU Extension agents, we accomplished this goal. By making that personal connection, we had a return rate of forty-five percent.

In 2017 we completed our second survey of rural grocers, again with the help of the NDSU Extension agents. The purpose of the 2017 survey was to assist in improving rural grocer access to current and future food distribution resources. We attempted to survey 127 stores and had a return rate of forty percent.

2017 NORTH DAKOTA RURAL GROCERS STUDY FINDINGS

Areas of concern

At the core of the issue is population decline and a diluted marketplace. Rural populations have experienced a slow, steady decline over the past few decades. As populations decline, the volumes of food required to feed those living in rural areas declines as well. Wholesale pricing is typically based on the volume of food purchased. The larger the volume, the lower the price. People now also have more options for securing their food than ever before. There are big box stores in more urban centers that boast of lower prices as well as online shopping options such as "Hello Fresh" and Amazon Prime. And, there is the recent emergence of Dollar General stores across the state that offer a mix of general items and groceries at a discount. These expanded options lead to declining volumes of food for the rural grocery operator.

The declining food demand in rural areas has a trickle-down effect. Traditional suppliers, such as Spartan Nash and Supervalu, have lost 42 percent of their market share to nontraditional grocery retailers, stores such as Walmart, Costco and Menards, according to Supermarket News 2015. The traditional suppliers are willing to deliver product to our rural communities, if it is cost effective. Options available to grocers vary among suppliers. The most affordable wholesale food is available to stores that purchase in larger volumes and can purchase whole cases. Stores with smaller volumes have fewer choices of suppliers and typically pay a higher wholesale price. Many of the rural grocery stores in North Dakota are supplied by convenience store suppliers, a higher cost wholesale product.

Smaller store operators face daily challenges to keep their doors open. Foremost is affordability and variety of products offered for sale. Many of the stores struggle to find suppliers for basics such as milk, bread and fresh meat products. Sometimes, due to low volumes, their wholesale price off the supply truck is higher than the retail price at big box stores. When this happens, grocers result to securing their product directly from the big box stores. Variety is also a challenge. Smaller stores cannot afford to buy each item by the case or they are unable to sell a whole case before the expiration date.

Grocer Challenges

Study results uncovered that rural grocery store operators face several challenges:

- Roughly 22 percent of the operators purchase some of their products from big box stores to either increase the variety of products they offer or reduce their cost. In some cases, the retail price at the big box store is lower than the offered wholesale price.

- Smaller stores need a supplier that will break up cases. A whole case is either more than they can sell before it expires or more than they can afford to store as inventory.

- Many of the stores are operating in older buildings and need updated coolers, freezers, heating and cooling systems, doors, windows, and roofs. Some stores do not have a point-of-sale system (cash register) in place. Many stores do not have debt capacity to entice new financing or cash on hand for upgrades.

- Grocery operators struggle to find employees. Most grocery operators are unable to compete with businesses with competitive wage and benefits.

- Approximately 50 percent of the rural stores struggle with low sales volume. A typical store with gross sales of $20,000 per week averages about $18,200 in annual net profit margin. Some store operators pay themselves prior to setting the net profit margin and some after it is set. This is too low to adequately maintain the building and operations.

- There are more than 50 direct store distributors (pizza, soda, chips, bread) that deliver small volumes of product directly to the stores.

Sales volume

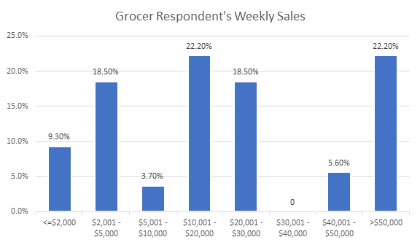

The figure below shows the relative weekly sales volume sizes for 54 responding stores. Rural grocery stores in North Dakota are represented by sales volumes across the spectrum. Slightly more than half of stores indicated that they had sales of $20,000 or less per week (53.7%). One-fourth of stores indicated that they had weekly sales between $20,001 and $50,000 (24.1%) and slightly less than one-fourth indicated that they had weekly sales greater than $50,000 (22.2%).

Figure: Weekly Sales Volume per Week Percentage Breakdown of Rural Grocery Stores, North Dakota, N=54

Low net profit margins

A startling discovery in this study was how low the annual net profit margins were for many of our stores. Around 51 percent of the stores in the state have gross weekly sales of $20,000 or less. Based on an annual net profit margin of 1.75 percent (the average), in North Dakota these stores net $18,200 or less per year. Some operators pay themselves before setting the net profit margins and some pay themselves from the net profit margins. Many of the store buildings and much of the equipment is old and in need of upgrades. With low net-profit margins, store owners are unable to keep up with their building needs. And, when profit margins are low, it is difficult to attract buyers or financing when it comes time to sell.

Efficiency

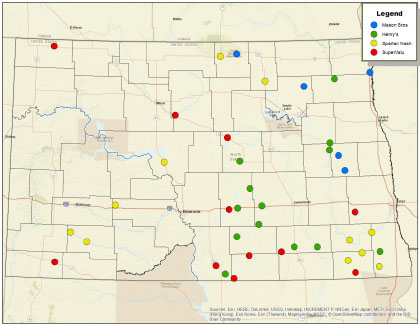

The figure below maps the primary wholesale supplier data collected through the recent grocer survey. There are four primary suppliers that serve most of the stores in North Dakota (Supervalu, Spartan Nash, Mason Brothers and Henry's). Each color represents one of the four suppliers. Note how interspersed the circles are on the map, which shows that wholesale distributors cross paths while servicing rural grocery stores.

Map: Primary wholesale grocery suppliers, North Dakota, 2018

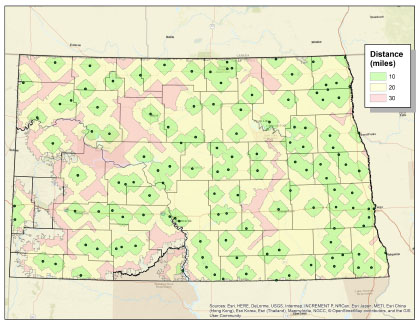

Food deserts

Early in our research, we learned of rural food deserts. Recently, the term has become more common as the issue is brought forward by entities that are concerned about public health. The map below illustrates our state's food deserts. As previously mentioned, about 51 percent of our stores struggle to generate any profits after accounting for expenses. If we were to remove 51 percent of the green shaded areas on the map below, the food desert landscape changes significantly. Many of us would need to drive significantly longer distances to secure our food, which could lead to poorer health outcomes for those having to drive longer distances for healthy food. According to data provided by the North Dakota Department of Health, individuals who live in food deserts have a higher incidence of obesity and diabetes.

Map: Distance to a grocery store, North Dakota, 2018

Collaboration

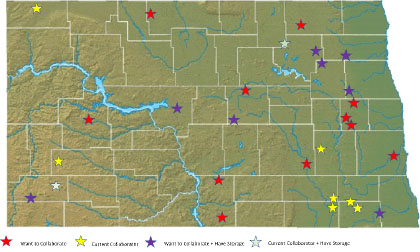

Results of our 2017 North Dakota Rural Grocers Survey show that there is interest in up to 50 percent of store respondents to engage in collaboration to lower prices and increase service from wholesale distributors. The survey also showed that there is a nexus of grocery stores that are interested in collaborating and stores that have excess grocery storage availability. That nexus is located in the northeast region of North Dakota. Follow on steps for further study include selecting a North Dakota region for communication with its grocers to ascertain interest in collaboration. Also, communication with grocery wholesale distributors within that region will commence to determine if grocery store purchasing collaboration is attractive for those distributors.

The study ascertained that 60 percent of the respondents were either currently purchasing food collaboratively or that they were interested in collaborative purchasing. The survey indicated that the cost of products from distributors was the primary concern of rural grocers. The demonstration of a collaboration between a major distributor and regional grocers could be a solution for cost concerns of rural grocers and efficiency concerns of wholesale distributors.

Map: ND Grocery Stores Currently or Wanting to Collaborate on Purchasing

Opportunities

This brings me back to the basic question: Is food access a concern in rural North Dakota? Based on the data, the answer appears to be a solid "yes", however, not without opportunities to change the existing course. North Dakota's rural grocery operators display a strong willingness to collaborate. This is imperative as they continue to compete with ever increasing competition in the retail grocery market, especially with our smaller populations.

There may also be opportunities to improve the efficiency of distribution through the development of redistribution hubs. Redistribution hubs could collect product from several different distributors in one location where it could be sorted by store and delivered to its destination. Would this help improve variety and decrease cost?

Perhaps it's time to contemplate this issue on a wider scale than simply the sustainability of rural grocery stores. For the good of a community, can we learn to collaborate on a larger scale? Is there a benefit for other businesses, such as restaurants, hospitals and schools to purchase together? Would this increase the purchase-volume enough to bring down the cost?

Another option is to determine whether there are public partners that have a vested interest in public health and rural places? The North Dakota Department of Health has a division that operates a distribution hub. Could they be a logical partner for distributing food to rural areas? Or, what about the Post Office? The Postal Service are a self-funded government entity that is struggling to sustain rural mail delivery. They need more volume to be efficient. Could they be a partner for grocers?

Change is never easy. It brings about anxiety and defensiveness. A change at this level will require people to put aside their assumptions of what won't work and a willingness to open themselves to a new way of doing business. The goal of this work is to confirm the current health of North Dakota’s rural grocery sector and to provide the information needed to inspire a change in the way the food is current distributed to rural areas.

CONSUMER INPUT SURVEY

The information gathered through the grocer surveys regarding quality of food, pricing, and variety/availability prompted us to ask the question: How do consumers feel about the food they purchase from their rural grocery store?

In 2017, through a survey distributed by Facebook and North Dakota Living magazine, a consumer survey was distributed to rural people -- 179 people completed the survey. The location of respondents were identified by zip code. Below is a snapshot of the results:

1. 56 percent of respondents purchase their food locally and 17 percent drive to an urban center.

2. Top reasons for selecting a shopping location (178 respondents/could select more than one):

a. Convenient location – 65%

b. Food selection – 40%

c. Convenient store hours – 37%

d. Low prices – 32%

e. Clean, neat store – 29%

f. Sales & promotions – 23%

g. Items on sale or specials – 23%

3. Sixty-four percent of shoppers were satisfied/very satisfied with their primary store.

4. Forty-seven percent of 179 respondents drive more than 10 miles to their primary store.

5. When asked to rank the challenge of the distance to shopping locations on a scale of 0 – 50, the median response is 31.

6. When asked what improvements shoppers would like to see at their primary store, the following were the top selections (168 respondents/ could select more than one)

a. Price/cost savings – 49%

b. More variety/better assortment/wider choice – 38%

c. More locally grown foods – 36%

d. More healthful, nutrition food items – 31%

e. More fresh-made foods – 24%

7. What is the most important fresh foods department at your primary store? Seventy-three percent of the respondents selected produce.

8. How often do you buy food online?

a. 56% - not at all

b. 28% - less than one time per month

c. 15% - one to two times per month

9. Age of respondents:

a. 18-37 - 26%

b. 38-51 - 28%

c. 52-70 - 44%

d. 71+ - 2%

10. Household income of respondents:

a. $50,000 or less 24%

b. $50,0001 - $75,000 20%

c. $75,001 - $100,000 27%

d. $10,001 - $150,000 23%

e. $150,001 - $250,000 5%

f. $250,001 + 1%

For more information on these studies, please contact Lori Capouch, lcapouch@ndarec.com, or 701-663-6501.