Ask A Researcher

April 2024

Sugarbeet Industry in the Northern Plains: Economic Contribution in Minnesota and North Dakota.

Dean Bangsund, NDSU, Agribusiness and Applied Economics

Nancy Hodur, NDSU, Center for Social Research

Dean Bangsund is an economist in the North Dakota State University (NDSU) Department of Agribusiness and Applied Economics. He specializes in impact assessment and has over 25 years of experience conducting applied economic research.

Dr. Nancy Hodur is the director of the Center for Social Research at NDSU and has over 25 years of professional experience in applied research, public policy, and outreach education.

Introduction to Sugarbeet Industry

Sugarbeet production, processing and marketing generate substantial economic activity in the Red River Valley in eastern North Dakota, western Minnesota and in west-central Minnesota. The industry is unique among conventional crops in that not only are sugarbeets produced in a concentrated area (e.g., Red River Valley) but they are also processed and marketed in the local production area. This unique structure means most of the economic effects of production, processing and marketing of the final products are captured in the local economies where sugarbeets are produced.

The sugarbeet industry is comprised of three distinct segments. Sugarbeet production includes planting, harvesting and delivery of sugarbeets to processing plants and piling stations. Sugarbeet processing converts sugarbeets into refined sugar, molasses and other by-products, such as beet pulp used as livestock feed. Sugarbeet marketing consists of the marketing and distribution of sugar and related products to end users (e.g., food manufacturing, grocery stores, livestock producers, export markets). All three activities are concentrated within a relatively small geographic area in the Red River Valley of western Minnesota and eastern North Dakota.

Total acres of sugarbeets planted is small compared to other regional crops such as corn, soybeans, and small grains. For example, roughly 630,000 acres of sugarbeets were planted in North Dakota and Minnesota in 2021 compared to 14.3 million acres of soybeans planted in North Dakota and Minnesota. That small physical footprint in terms of acres planted however can be misleading in terms of relative economic effect. The per-acre value of sugarbeets is high compared to the per-acre value of most other crops raised in the region. Adding to the economic effects of sugarbeet production, sugarbeet processing plants are located in the same sugarbeet growing regions in Minnesota and North Dakota and most of the inputs to production, processing and marketing are made in the local production region. The concentration of sugarbeet production, processing and marketing makes the sugarbeet industry an important economic contributor to rural economies in both Minnesota and North Dakota.

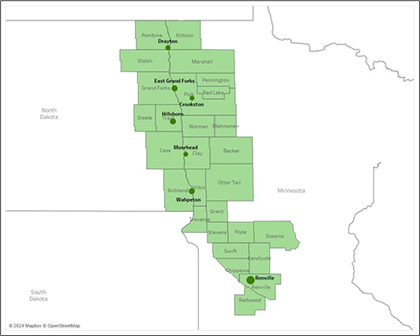

Sugarbeet producing counties and processing facilities in eastern North Dakota, western Minnesota and west-central Minnesota.

Because of the economic significance to local economies, the industry has been periodically assessed since 1987. The assessment demonstrates the economic significance of the industry to state and local economies to policymakers, community leaders, legislators, business leaders, and the general public.

Recently the NDSU Department of Agribusiness and Applied Economics conducted an economic impact assessment of the regional sugarbeet industry. Financial data and other metrics from industry firms in Minnesota and North Dakota along with secondary data on production inputs were used to estimate the economic effect of the industry. Customized models were developed using industry data in conjunction with a multiple-region INPLAN input-output analysis that included cross-state commerce among Minnesota, North Dakota, and South Dakota. The custom models and multi-state approach estimate secondary economic effects. Secondary economic effects arise from the purchase of goods and services used to produce, process and market sugarbeets. Secondary effects also include personal spending (i.e., household goods and services) by the industry’s workforce. Both direct and secondary effects are estimated for employment, labor income, and gross business volume. Findings related to value-added and government revenues can be found at https://ageconsearch.umn.edu/record/339741?ln=en&v=pdf

Direct Economic Effects

In 2021, 638,000 acres of sugarbeets were planted in Minnesota and North Dakota and 605,200 acres were harvested. From that harvest, 16.9 million tons of sugarbeets were processed and converted into refined sugar, molasses, and other byproducts such as beet pulp used as cattle feed.

Employment. Sugarbeet production and research supported 1,840 jobs, of which 1,075 were self-employed sugarbeet producers. The remaining 765 jobs were wage and salary jobs. Employment related to sugarbeet production generated $406 million in employment and sole proprietor income. Sugarbeet processing and marketing supported an additional 2,570 jobs resulting in total direct industry employment of 4,410 jobs. Processors also reported an additional 880 seasonal contract employment jobs associated with the sugarbeet harvest campaign. Employment associated with sugarbeet processing and marketing generated $273 million in employment income. Seasonal on-farm labor for sugarbeet harvest was not estimated.

Gross Business Volume (i.e., typically synonymous with sales). Gross business volume is the measure of total economic activity and represents sales revenues in all economic sectors. Direct output (sales) associated with the sugarbeet industry in the tri-state region (Minnesota, North Dakota and South Dakota) was estimated at $3.55 billion. About 44 percent or $1.1 billion of industry output was associated with sugarbeet production. The remaining $2.5 billion in direct industry output was associated with sugarbeet processing and sugar marketing, which illustrates the significance of processing and marketing activities co-located in the same region as sugarbeet production.

Purchasing of Goods and Services. An important factor in how an industry affects state and local economies is the purchase of goods and services used to produce a product (i.e., intermediate inputs) and to what degree those inputs are acquired in the local area. Examples of intermediate inputs for sugarbeet production include seed, fuel, fertilizer, and labor. Examples of intermediate input for processing and marketing include sugarbeets, processing materials utilities, insurance, finance, annual plant maintenance, and freight and transportation.

The sugarbeet industry purchased over $2.4 billion in goods and services for intermediate inputs in the 2021-2022 production year. Of that total, 83 percent or $2 billion worth of goods and services were acquired from entities in the tri-state region. Seventy nine percent or $1.9 billion of intermediate inputs were associated with sugarbeet processing and marketing, of which $1.5 billion were made to entities in the tri-state region. Of the $1.5 billion in payments for intermediate inputs for sugarbeet processing, nearly $1.1 billion represented payments to sugarbeet producers in North Dakota and Minnesota.

Secondary Economic Effects of the Sugarbeet Industry

Because of the concentration of production, processing, and marketing of sugarbeets in the same geographic area and the high percentage of intermediate inputs acquired locally, combined with substantial large labor income for its producers and employees, the secondary economic effects associated with the sugarbeet industry are substantial.

Employment. Secondary employment in the study’s tri-state region for all segments of the industry supported an estimated 11,900 jobs with an estimated $844 million in labor income for wages, salaries, benefits, and income for sole-proprietors. Combined with total direct industry employment of 4,410, the sugarbeet industry supported 16,310 jobs. Direct and secondary labor income for the industry was estimated at $1.6 billion.

Gross Business Volume. Secondary gross business volume for all segments of the industry, which represents sales revenue in all economic sectors in the tri-state region, was estimated at $2.6 billion. Combined with total direct gross business volume, the sugarbeet industry generated $6.1 billion in total (direct and secondary) business volume. Sixty one percent, $3.7 billion, of total (direct and secondary) gross business volume was attributable to business activity associated with sugarbeet processing and marketing. The remaining 39 percent, $2.4 billion was associated with activities associated with sugarbeet production.

Placing Data into Context

Describing industry activities as a share of the statewide economy is helpful to put an industry’s contribution into context. In Minnesota, the sugarbeet industry was estimated to represent about 0.3 percent of employment, 0.4 percent of the state’s total labor income, and 0.5 percent of the state’s total gross business volume. The industry was estimated to have a slightly larger relative contribution to the North Dakota economy despite the sugarbeet industry having a smaller economic footprint in North Dakota. The difference in the relative contribution is attributable to North Dakota having a much smaller state economy than Minnesota. In North Dakota, the industry represented about 1.1 percent of total employment, 1.5 percent of the state’s total labor income, and 1.6 percent of total gross business volume.

While the sugarbeet industry may seem quite small relative to total state economies of North Dakota and Minnesota, an examination of per-acre effects provides a different perspective. In terms of production activities, each planted acre of sugarbeets supports about $2,500 in economy-wide labor income and $9,600 in gross business volume. Each 39 acres of planted sugarbeets supports one job (direct and secondary employment). And each ton of sugarbeets processed and converted to finished marketed products generates $93 in economy-wide labor income and $360 in gross business volume. One job is supported for every 1,037 tons of sugarbeets processed and marketed.

Conclusion

While economic activities associated with sugarbeet production are smaller than that of major crops like corn and soybeans, regionally, the industry generates substantial economic activity with a relatively small amount of acreage. Further economic activity associated with not only production, but value-added processing and marketing is largely done in the local production region generating substantial secondary economic effects. The sugarbeet industry in eastern North Dakota and western and south-central Minnesota continues to generate substantial state and local economic activity.